The original URL of this article is:

www.africaspeaks.com/kenya/05072007.html

Keron Niles' Academic Report on Kenya

by Keron Niles

July 05, 2007

UWI Students Trip to Kenya

| | | Keron Niles | |

Topic: A question on policy - What is the role of social and/or economic policy in improving the quality of life of individuals? Answer based on your observations of life in Kenya, stating what social and/or economic policy(s) would you prescribe in order to achieve greater standards of living.

There is no single social or economic policy which impacted upon the quality of my experience in Kenya as immediately or as significantly as the Kenya Budget 2006. In a policy move that was being described as a "Policy for the people", Finance Minister of the Republic of Kenya, Mr. Amos Kimunya outlined that the budget was designed "so Kenyans can have their daily bread more cheaply". The Kenyan budget 2006 had very different impacts on different groups of people as it was said to be geared towards enhancing the lives of the poor in Kenya. As such, while I will give a brief insight into this economic policy, reference will also be made to similar policy decisions in Trinidad and Tobago introduced in our Budget in 2006. Quite interestingly however, both budgets in 2006: in Kenya and in Trinidad and Tobago were being delivered near to an election year. Not surprisingly therefore, both budget presentations bore an uncanny resemblance to each other. In giving a brief overview of a few of their similarities, it is also my intention to (a) give some examples of the types of social or economic policies that I would prescribe in order to achieve greater standards of living in general.

The term budget refers to "an annual or regular estimate of national revenue and expenditure put forward by the government, often including details of changes in taxation." In practice, a budget is a statement of intent which not only clearly outlines the government's approach to the current state of the economy but reflects the overall vision of the state, especially as it pertains to social and economic policy.

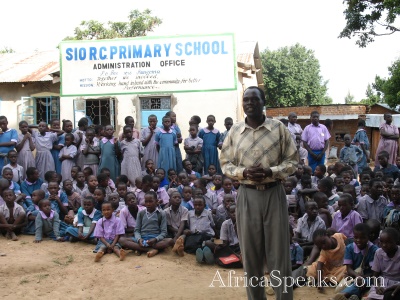

In order to fully understand the impact of the Budget upon the Kenyan society one must first gain an appreciation of the very pronounced difference between rural and urban Kenya. Kenya's urban and town centres are highly populated, dense economic and social hubs of activity, where roads are usually paved and the buildings fitted with both water and electricity. While accommodation in these urban centres are seemingly desirable, the urban centres also house many slum settlements (some of which are not legal) where the standard of living is very low. The culture and lifestyles in these areas centre around peoples' economic livelihood and survival. Life in rural Kenya is based upon tribal and community traditions. As the resources which exist and support the people, belong to the community. A classic example of this be seen through the examination of the education system in Kenya. Most, if not all of the public Primary schools we visited in Bungoma and Kakamega were built by persons from the community for the community. Resultantly, there exists a strong sense of ownership by the community of the primary schools in the area. Notwithstanding this, not many homes within these rural areas are fitted with water or electricity. In fact, many residents in these areas live in mud huts which differ in size and design according to which tribe occupies the area. Due to the high price of gas and the fact that there not many paved roads in rural Kenya, not many persons own cars. The majority of the population travel using a 'matatu' which is very similar to what is commonly called a 'maxi-taxi' in Trinidad and Tobago or by using a 'boda-boda' which is actually a bicycle with seat for a passenger behind the rider.

| | Sio R.C. Primary School built by persons from the community |

Declaring that the budget would definitely benefit the majority of the Kenyan population, Minister Kimunya outlined that constituency budgets were increased by as much as 50 million Kenya shillings (approximately TT $5millon dollars) to enable Members of Parliament to do more for their constituents. Businessmen and businesswomen were also said to have benefited as one hundred and eighteen (118) business licences were abolished. The government also claimed to be pro-family and as such removed the taxes on wheat, flour, diapers and sugar. The youth of Kenya were also notable beneficiaries of the Budget as 100 million Kenya shillings (which, when abbreviated, is written Ksh) was allocated towards a Kenya Youth Council which was to be set up and another billion Kenya shillings was put into a Youth Enterprise Fund. The Ministry of Education was also received the largest budgetary allocation of all the state enterprises. The real intention of these initiatives according to Minister Kimunya was to enable persons to save money on vital commodities while empowering the youth, giving them the resources necessary to help themselves. It is desire, according to the government of Kenya, which also motivated them to remove the import duty on "Completely Knocked Down (CKD)" bicycles kits which we are used in Kenya to assemble bicycles and motor cycles. The government hoped that this would ameliorate the conditions under which 'boda boda' operators had to survive especially since such persons were more likely to come from the lower - income brackets of the Kenyan society.

On the hand, the budget would have adversely affected many persons with greater disposable incomes, including tourists. Though we told the Kenyan Immigration Department that we were international student volunteers; as far as facing reality this was concerned, we were tourists. In what was being described by the Kenyan press as "a bitter pill", the budget increased the Road Maintenance Levy which brought with it a raise in the price of petrol by Ksh3.20 per litre. While this did affect persons from the "middle-income bracket" who owned vehicles, it also affected commuters who utilised public transport as fares were increased three days following the budget. Unfortunately, the KVDS rented public transport for the duration of our visit, since they believed this to be an economical means of travelling throughout. The head of the KVDS, Mr. Malaho; explained to me that they were affected quite adversely by the budget since they were paying the owner of the vehicles via installments and because they were still responsible for putting fuel in the vehicles daily. He noted that while he understood that it was too late to ask us to make another financial contribution to help cover this additional cost, all of our activities would have to be re-scheduled (in some cases and organised) according to the location of the activity and its distance from our accommodation. Our circumstance, as it pertained to transport was exacerbated by the fact that the KVDS had rented two 'matatus' for the duration of our stay in Kenya. Every excursion which we took now depended on how much gasoline the journey would consume.

Notwithstanding this, the taxes on wine and certain categories of cigarettes were also increased. The intent on the part of the government therefore, seemed to be to make items that can be viewed as necessities as cheaper and by extension more accessible to members of public while causing the prices of goods that can be referred to as luxury or leisure items to increase. Hence it is perhaps in this spirit of taxing the 'big spenders' in the economy that the government surprisingly introduced a tax to be paid on the previously 'un-taxed' salaries and allowances of all Members of Parliament. Minister Kimunya also stated government ministers were now only allowed one official vehicle. The move was expected to add in excess of five hundred million Kenya shillings to government revenue; money which the government boasted would be placed into the Constituency Development Fund, used to repair roads and to buy land for farmers.

| | The main road in Shikunga Village, an example of an unpaved road |

Likewise, the government of Trinidad and Tobago declared its intention to continue its support of its communities through the strengthening of the family. In his delivery of the Budget in 2006, Prime Minister and Minister of Finance, The Honourable Mr. Patrick Manning noted that his government is committed to "offering effective social support to the poor and vulnerable, to providing affordable housing and to ensuring that citizens receive quality healthcare by expanding the availability and strengthening the delivery of health and wellness services." To help achieve this the government, he announced would continue its tradition of allocating the largest budget to the Ministry of Education. In addition (and quite similar to the Kenyan government) he noted that his government had made significant strides in guiding the formation of a National Youth Council, the implementation of a National Youth Policy and in the establishment of a Youth-Based Support Fund for Community Projects. He continued by adding that his government's commitment to the communities of Trinidad and Tobago could be seen through its continued support of community outreach projects by government and non-governmental agencies. The formation of a National Infrastructure Development Company (NIDCO) he added was part of the government's drive to extend some of the nation's highways, construct more bridges and an interchange while continuing to repair existing roadways.

Though Kenya and Trinidad and Tobago may be faced with entirely different circumstances as it pertains to trying to maintain affordable prices for petrol (as the latter is a major world exporter of natural gas) we do share many of the same struggles in attempting to control the price of other key commodities, such flour and sugar. Yet in either country, there seems to be insufficient enforcement and monitoring regulations and practices, to guide the implementation of socio-economic policy. Via the launch of its SMART Card, the government of Trinidad and Tobago aimed to assist families in need to by giving them cards valued at TT$300, TT$400 or TT$500 (according to the size of the family) which could be used to purchase selected food items at participating supermarkets. The government of Kenya on other hand simply used new taxation policies, to enable manufacturers to charge lower prices for food items which could be considered as necessities. Yet reports of 'SMART' Card abuse in Trinidad and Tobago surfaced as persons attempted (with some measure of success) to use their own personal contacts at participating supermarkets to purchase goods not on the government's list of selected items, such as alcohol. Similar difficulties with respect to the implementation of government policy were being experienced in Kenya as prices of some of the goods, including flour, targeted by the government did not decrease (even up to a week after the budget). Some retailers noted that as the price of petrol increased, so did the cost of transport, making it difficult for them (especially those in rural areas) to decrease prices. Others simply stated that they intended on reducing prices but were still selling stock purchased before the budget was read. As such, complaints about high food prices and the inability of policy of impact upon the quality of life still continue in both Kenya and Trinidad and Tobago. Perhaps it would be prudent for either government to consider more stringent implementation regulations; such as (in the case of Trinidad and Tobago) greater penalties for those who abuse the 'SMART' Card programme or incentives for retailers who make valuable recommendations as to how to prevent abuse of the 'SMART' Card programme.

Additionally, it is necessary to empower persons with the knowledge of how to use whatever resources they have, great or small. I would therefore assert that a vigorous public 'Spend Wisely' Campaign is necessary (in both Kenya and Trinidad and Tobago) in order to guide persons through the principles of spending, budgeting, saving and overall financial management. In rural Kenya, most of the student delegates, inclusive of myself marveled at how persons and families were able to use very little resources to not survive, but live enjoyable lives. I was able to observe how families were able to utilize every acre of their land to support themselves and how even materials were stored and saved to enable them to live comfortably in times of lack. We also noted that there was little or no dependence or reliance upon the state to provide for them. As a matter of a fact, most persons whom we conversed with in rural Kenya stressed on the methods they used to provide for themselves and their families. In contrast, there seems to be high levels of dependence upon the government to provide for members of the public in Trinidad and Tobago. Perhaps very strong messages pertaining to prudent financial and even asset management or simply "Managing what You have" might lead to decreased levels of dependence upon the government.

The autonomy of the family and the community in rural Kenya was also evident in the provision of certain social services. As was mentioned earlier, most of the schools we visited in rural Kenya were built by the communities for the communities; even where different tribes existed in the community. As such, there was a great sense of ownership of community resources and assets by members of the community. The same sentiment therefore applied to community centres and meeting areas. In many cases, the people of the community combined with the produce of their hands and whatever other resources they owned with those of the community in order to furnish themselves with almost everything they required. I cannot however posit that the communities we visited were entirely autonomous as many of those communities expressed that they were able achieve their goals through hard work and through the 'kind donations' of international volunteers (like ourselves) and through other international organisations, including churches. They therefore expressed a greater level of dependence on independent organisations than their government. Despite this fact, I do believe that much can be learned from observing how those communities seek to provide for themselves, those things which they desire; not through protests and blocking roadways but through a strong sense of ownership of their community and teamwork.

| | Faraha Women's Action Group |

The individual or collective efforts of members of the public however, to provide for themselves does not negate the positive impact that good social and economic policy can have upon the quality of lives of the citizens of a country. While Kenyan communities do experience insularities and incidents of conflict between the tribes resident there, they do manage to support themselves. Assuming that the conflict and insularity experienced between and among tribes in Kenya is comparable to the racial insularity experienced in Trinidad and Tobago (and from my brief observations, I do have that impression) then perhaps social and economic policies should be emphasized or focussed on the community in the latter. At present, if one were to use the high levels of dependence on the government expressed by some communities in Trinidad and Tobago as an indicator; there would certainly seem to be a gap between social policy and community development and empowerment. Perhaps in lieu of simply funding community outreach programmes and projects, it may be time to place the resources necessary for the community to help themselves; in the hands of the communities. This may require the require a large-scale re-establishment of many community councils and the allocation of land and other resources and materials to such bodies (which may be costly); but it would place communities in a position where they would be accountable for solving their own problems.

It is social and economic policy of this nature which would enable members of the public to claim ownership of their own communities; allowing them to establish those institutions and amenities necessary for the proliferation of high-quality lifestyles. It should also decrease the level of centralised monitoring and enforcement necessary, especially after the new policy, particularly through the budget, is introduced. Though the intent of the governments of both Kenya and Trinidad and Tobago may have been to utilise the fiscal, economic and social policies in their budgets to ameliorate the living conditions of their electorate; effective implementation strategies continue to be problematic. Placing the implementation of such policy ideas into the hands of the community and their community leaders may indeed be the doorway to ensuring that the social and economic policies of the government impact positively upon the quality of life experienced by the average citizen.

Bibliography

"Bitter Pills in Kimunya's Budget: Kenyans wake up to the reality of increased petrol, consumer goods and commuter costs" Saturday Standard 17 June 2006: p. 1.

Akumu, Washington. "Budget 2006: Shocks and Suprises" Daily Nation 16 June 2006: p. 1.

Omari, Emman. "How MPs could hand Kenya Sh660 million" Saturday Nation 17 June 2006 p. 1-2.

Oyuke, John. "Education ministry gets highest portion" The Saturday Standard 17 June 2006 p. 3.

The Government of the Republic of Trinidad and Tobago. "Budget 2006". Electronically sourced from http://www.gov.tt/news/news_article.asp?id=3730.

UWI Students Trip to Kenya in pictures:

http://rastafarispeaks.com/gallery/Trip_to_Africa_2006

|

|